Red Hot & Blue is a 33-year-old multi-unit restaurant system in the BBQ category. The first Red Hot & Blue restaurant opened in Arlington, Virginia in 1988, started by Lee Atwater, Don Sundquist and friends. Don was from Memphis, Tennessee and served in the U.S. House of Representatives and later as governor of Tennessee. The late Lee Atwater was an amateur blues musician and political figure who managed George H.W. Bush’s successful race for the presidency. These men were friends who longed for authentic barbecue and great blues music. Unable to find that combination anywhere in the Washington, DC, area they decided the only way to get it done was to open a restaurant of their own.

For its first 23 years, Red Hot & Blue was a strong and growing brand with a positive culture. The company expanded rapidly, opening 30 locations in Washington, DC; Dallas, Texas; and smaller cities with individual franchisees. In 2008, it was purchased by inexperienced operators – financed with a substantial amount of debt – just before the recession hit. Over the next 10 years, it was stripped of its foundation at the same time the casual dining segment began to shift. AJB Capital purchased the business in April 2018 with a vision to restore the brand and reposition it for growth.

AJB Capital’s vision: Restore Red Hot & Blue’s beloved brand and history while capitalizing on the BBQ category’s potential. Drive strong unit economics in new locations and grow into a successful multi-unit system.

AJB Capital’s strategy: Optimize the current system as a bridge to growth. This is being executed in four stages: i) acquire, ii) fix the current operations, iii) reposition the company, and i) grow profitability through unit expansion.

AJB Capital’s execution: We restructured the company’s existing units into individual franchises. We sold assets, paid off debt, and turned our focus to developing a strong infrastructure of capabilities within operations, people, marketing, finance, and real estate. Along the way, we developed and built the tools, systems, and culture needed to execute our vision and strategy.

Where We Started

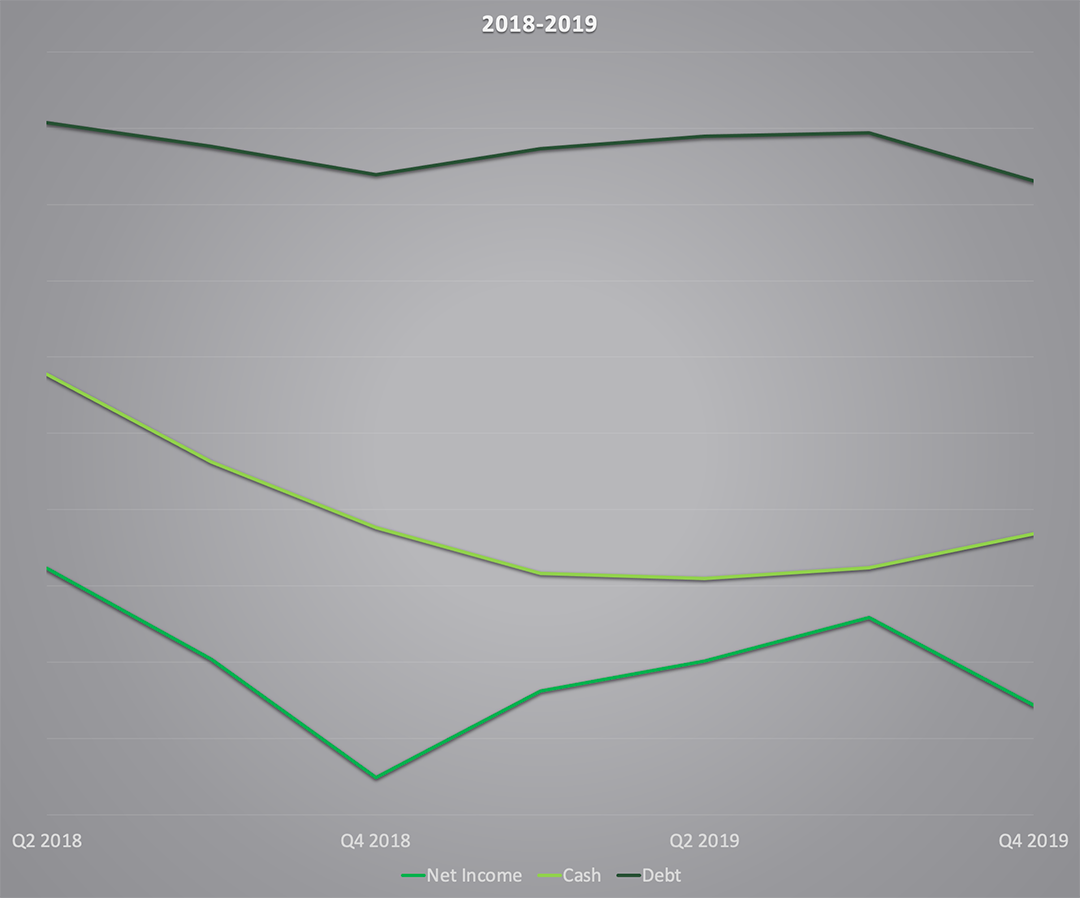

As Red Hot & Blue was mismanaged for the 10 years preceding our acquisition, the company lost its internal systems and capabilities while its assets were stripped to meet fixed obligations. The culture was broken. AJB Capital saw through the mismanagement to the power of the brand and the potential of the category, acquiring its assets through a new entity. It took some time to stop the bleeding. Losses accelerated, and cash declined. Assumed debt (mainly from restructured franchises) remained elevated.

In November 2018, AJB Capital CEO Adam Bradley began restructuring the leadership team and placing the business more firmly on its intended path.

Debt was elevated, and cash net income initially declined

By March 2019, Adam assumed full CEO leadership of Red Hot & Blue and began fixing the business. Operating losses shrank. By March 2020, the business had begun to stabilize when COVID-19 hit. This began an intense focus on continuous improvement and finalizing the fix phase. We managed the system through the early stage of the pandemic, keeping all locations open and operational.

In November 2020, we completed the refranchising of existing company units in the Dallas and DC markets and extinguishing debts. AJB Capital began building the leadership team with competencies in the most immediate areas of need: operations, data systems, and guest-facing technology. Operations was the priority, where AJB Capital implemented a system of standards, oversight, and accountability.

As we began to fix the business, losses were stemmed. We built cash through asset dispositions. Then COVID hit. ...We successfully navigated the early phase, with all locations open and operating after initial shutdowns.

Throughout 2021, AJB Capital continued to build out the leadership team and systems, including data analytics, technology and tools, marketing, finance and accounting, and real estate. This team built a solid operating platform by executing 21 separate initiatives, preparing Red Hot & Blue for the growth phase.

We significantly improved profitability, increased cash, and reduced debt.

Where We Are Now

Red Hot & Blue’s operations have been segmented into full-service franchised operations and fast-casual company units. These fast-casual units have been redesigned under a new format, which we call “BBQ Theater.” Our first location is under construction at Park West Village in Morrisville, NC with a scheduled opening of May/June 2022. Additional units are in development. The business overall is consistently profitable, showing strong cash flow and nearly all debts paid off by year end 2021.

BBQ Theater

Red Hot & Blue’s Board

Expertise in multi-unit, marketing, operations, real estate, and investment finance

Bob Barry

CEO

ZIPS Dry Cleaning

Patrick Bracewell

Chairman & CEO

Forge Group, Inc.

Adam Bradley

Founder, CIO & CEO

AJB Capital

Austin Williams

Partner

Crosland Southeast

Robert Hubbard

Managing Partner

Mexican Inn Cafes

Dr. Fitzpatrick

Chief Medical Officer

Deaconess Women’s Hospital

Where Are We Going

AJB Capital has driven a high level of improvement at Red Hot & Blue, taking it from a struggling company with a large debt load and operating losses to one with strong and consistent operating profit and minimal debt. Our leadership team has simplified operations, improved decision-making backed by data and analytics, and implemented technology to improve the guest experience. We have designed a highly profitable format that serves guests’ updated expectations while reducing the fixed costs that plague multi-unit systems throughout the business cycle. We continue to increase value for our people and investors.

BBQ Theater is the value-creation vehicle for the next phase of growth for Red Hot & Blue while franchised operations provide the cash flow for investment in our new company units. We have taken the best parts of Red Hot & Blue: the BBQ, the history, purchasing and off-premise leadership and left behind the rest.

Our brand has a tremendous opportunity for value creation, and AJB Capital is focused on maximizing it. Our unit economics are the driver of our growth and the basis for this value creation. We are developing our strategy and resources to launch a larger base of units in 2023, propelling the brand for longer-term growth.

Our vision contemplates a near-term run rate of 8-10 new units in 2023-2024, achieving 30-50% unit growth each year, depending on market factors, thereafter.